unemployment tax credit irs

990-EZ 990-PF or 990-T returns filed with the IRS by charities and non-profits. Return due date or return received date whichever is later processing date.

Millions Might Get A Refund With The 10 200 Unemployment Tax Break But Filing An Amended Return Could Unlock Even More Money Marketwatch

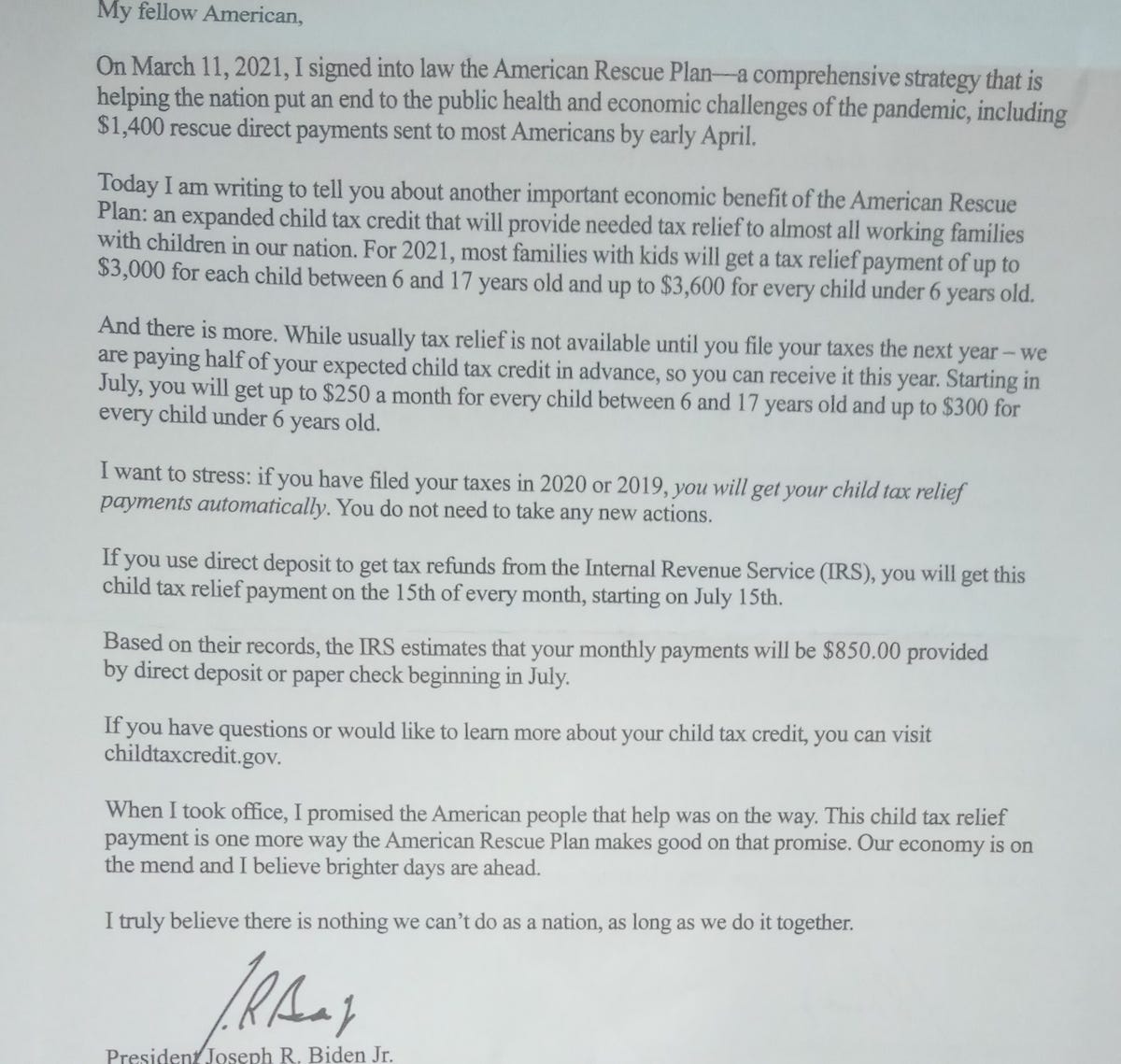

On March 11.

. Total SE Tax 195. Tax per Return 888. The procedure for requesting the third stimulus check that has not arrived to you.

Tax refunds on unemployment benefits to start in May. IRS tax deadline. To qualify for the full tax credit individuals must earn less than 75000 joint filers must make less than 150000 and heads of households must earn less than 112500.

Retirement and health contributions extended to May 17 but estimated payments still due April 15. If you paid zero taxes there is nothing to refund by having less taxable. The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only.

If you are still eligible and have. SE Taxable Income 1277. The IRS has already processed most of the 1400 third round payments.

Forms and Instructions. The Internal Revenue Service IRS announced it will start to automatically correct tax returns for those who filed for unemployment in 2020 and qualify for the 10200 tax break. If your non refundable tax credits covered you total tax liability that means you paid 0 taxes.

Your employer on the other hand may be eligible for a credit of up. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of. The federal income tax treatment of UC depends on the type of program paying the.

The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits. However taxpayers may still have to pay federal and state income taxes on that income. From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee.

The legislation allows taxpayers who earned less than.

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Stimulus Check Update You Won T Have To Pay Federal Tax On First 10k Of Unemployment Benefits Under New Bill Nj Com

Irs Issues More Tax Refunds Relating To Jobless Benefits

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Brproud Still Waiting On Your Unemployment Refund Irs To Send More Checks In July

Irs Issues New Batch Of 1 5 Million Unemployment Refunds

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

2020 Unemployment Tax Break H R Block

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

What To Know About How Covid 19 Pandemic Changed Tax Laws

10 200 Unemployment Tax Break Irs To Automatically Process Refunds

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

Tax Relief Notification Texas Workforce Commission

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor